Dwolla, an e-wallet platform, offers a robust and comprehensive solution to meet the need for secure, fast transaction processing. In this in-depth guide, we will explore the features and benefits, explaining why it's such a strong contender in the United States digital wallet space.

Short Background and History

Dwolla was founded in 2008 by Ben Milne and Shane Neuerburg to provide a secure, reliable, and cost-effective alternative to traditional banking methods. Over the years, the platform has evolved to become a versatile and powerful digital payment solution, serving a diverse range of individual users and businesses.

Today, it processes billions of dollars in transactions, offering a range of features and tools to streamline the payment process.

Dwolla Features and Benefits

Speed and Efficiency of ACH

One of Dwolla's core strengths lies in its ability to deliver fast and efficient transaction processing. By leveraging the Automated Clearing House (ACH)Network, the platform ensures users can move funds between bank accounts with minimal delays. This is particularly appealing to anyone who requires quick and seamless money transfers, aka freelancers, online retailers, and gig economy workers.

Dwolla also offers a Same Day ACH feature for even quicker transactions, allowing businesses to stay competitive in an increasingly fast-paced financial landscape.

To learn more about ACH and how to use it, check out its official page.

Customizable API

Dwolla features a powerful and customizable API. Developers can build and integrate their own unique payment solutions using the e-wallet’s infrastructure, creating tailored payment experiences that cater to the specific needs of users and businesses. The API is designed to be easy to work with and highly flexible, allowing for the creation of a wide range of payment applications and services.

Advanced Security Measures

In an era of cyber threats and data breaches, security is a top priority for any digital payment platform. Dwolla employs a range of advanced security measures to protect user's sensitive information and funds. These measures include bank-level encryption, multi-factor authentication, and continuous monitoring for suspicious activity.

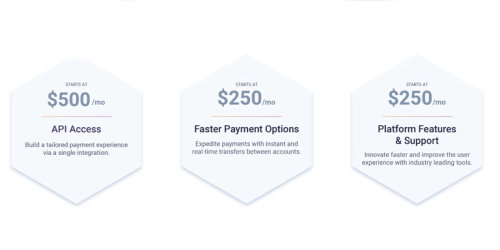

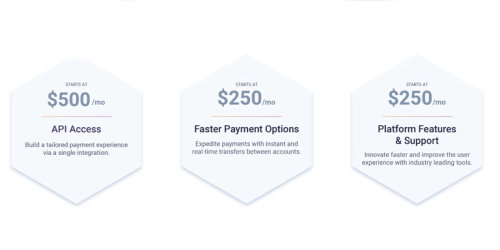

Competitive Pricing for Businesses

By using Dwolla, businesses can reduce the costs associated with traditional payment methods, such as credit card processing fees. The digital wallet offers an attractive pricing structure compared to many other payment solutions.

With lower fees for transactions and no hidden costs, users can keep more of their money and make the most of their e-wallet. This cost-effective approach makes Dwolla an appealing option for both individuals and businesses, especially those looking to minimize overheads and maximize profits.

Dwolla's Mass Payments

This feature is a potent tool for businesses that need to send payments to numerous recipients simultaneously. Whether it's disbursing payments to freelance contributors, giving out rewards to a large customer base, or managing payroll for employees, Dwolla Mass Payouts makes the process simple, swift, and efficient.

With just a single API call, businesses can schedule and send payments to up to 5,000 recipients at once. This feature not only saves time but also improves operational efficiency by streamlining what could otherwise be a cumbersome and error-prone process.

The ability to automate large-scale payments is a crucial aspect of Dwolla's offering, positioning it as a leading solution for businesses with substantial payout needs.

Learn more through the official Dwolla Mass-Payments page.

International Business Payments

Currencycloud integration allows cross-border payment processing. Currencycloud lets Dwolla customers access an international payment network of 38 currencies in 180 countries with just a few clicks. Learn more through the official International Payments with Dwolla page.

White Label Solutions

For businesses looking to offer their customers a flawless and fully branded payment experience, Dwolla white-label payment solutions are an ideal choice. By leveraging Dwolla technology under their own brand, companies can provide a smooth and integrated payment experience for their clients without the need to develop their own infrastructure from scratch.

This can save businesses time, money, and resources while maintaining a high level of customer satisfaction.

Enhanced User Experience

Dwolla's user-friendly interface, visualization tools and intuitive integration capabilities improve the overall experience for both businesses and their customers. By offering a simple and secure payment solution, businesses can enhance customer satisfaction and loyalty.

Easy Integration

Dwolla API is designed for easy integration with existing business applications and platforms. This allows fast payment processing implementation without extensive development effort.

Timesaving

Dwolla's instant payment processing capabilities save businesses time by enabling them to manage their finances more efficiently. By automating payments and streamlining transactions, entrepreneurs can focus on their core operations rather than spending time on manual payment processing tasks.

Scalability

Dwolla platform is built to handle high transaction volumes, making it a suitable option for companies experiencing rapid growth. The platform can easily scale with your business as your payment processing capabilities continue to evolve.

Comprehensive Developer Resources

To support developers working with the Dwolla API, the platform provides extensive documentation, guides, and resources. These materials ensure developers have the information and support they need to effectively utilize the e-wallet’s technology and build powerful payment solutions. Additionally, Dwolla developer community offers a forum for collaboration, knowledge sharing, and problem-solving, further enhancing the platform's appeal to tech-savvy users.

Check out the Blog section for insights from industry experts and the latest updates.

Dedicated Customer Support

Dwolla is committed to providing excellent customer support. The platform offers responsive and knowledgeable assistance through various channels, including email, phone, and live chat. Users can also access a comprehensive help center, which features a wealth of information on common issues, troubleshooting tips, and best practices. This commitment to customer support ensures clients can rely on fintech company to provide the assistance they need, whenever they need it. Find out more at Dwolla official tech support page.

Dwolla Third-Party Integrations

Dwolla's flexible API enables smooth integrations with various third-party services and platforms, enhancing the overall functionality for businesses. These integrations help to create a more efficient and user-friendly payment ecosystem for both entrepreneurs and their customers. Below are some notable examples:

Plaid Integration

Plaid is a financial data platform that enables users to connect their bank accounts to various fintech applications. By integrating with Plaid, Dwolla allows businesses to simplify the bank account verification process, reducing the potential for errors and ensuring a smoother user experience. This integration also allows clients to verify their bank account balances in real-time, providing a more accurate representation of their available funds. Learn more about integrating Plaid with Dwolla through the official page.

Sift Integration

Sift is a fraud detection and prevention platform that uses machine learning algorithms to identify and block fraudulent activity. By integrating with Sift, Dwolla enhances its security features, helping businesses to identify and prevent fraudulent transactions. This integration also enables customizing fraud prevention strategies, tailoring them to specific needs and requirements. Learn more about Sift + Dwolla integration through the Dwolla official page.

Slack Integration

Slack is a popular team collaboration and communication platform used by businesses across various industries. By integrating with Slack, Dwolla allows companies to receive real-time notifications and updates on payment events directly within their Slack workspace. This integration streamlines communication and helps teams stay informed about payment-related activities, making it easier for them to address potential issues and ensure efficient payment processing. Learn more about Slack + Dwolla integration through the official page.

QuickBooks Integration

QuickBooks is a widely used accounting software that helps businesses manage their finances. By integrating with QuickBooks, Dwolla allows automatic payment data synchronization, streamlining the accounting process and ensuring accurate financial records. This integration saves time and effort by eliminating the need for manual data entry and reducing the risk of errors.

Learn more about QuickBooks + Dwolla integration through the official QuickBooks page.

Dwolla integrations with AWS (Amazon Web Services) & Tableau represent the union of payment solutions, advanced cloud computing, and data visualization technologies.

Amazon Web Services

When it comes to AWS, Dwolla integration enables businesses to harness the scalability, flexibility, and security that Amazon's cloud platform provides. AWS's vast suite of services can facilitate improved application performance and data management. This integration makes it possible to operate financial transactions smoothly while ensuring robust security and compliance measures are in place.

Tableau Integration

The integration with Tableau, a leading data visualization tool, further enhances Dwolla service by providing users with intuitive and interactive ways to understand their transaction data. This integration empowers businesses to visualize their payment data in real-time, gain insights, and make data-driven decisions. By synthesizing complex payment data into understandable and actionable visual reports, entrepreneurs can optimize their strategies and enhance their performance.

These are just a few examples of the many integrations that Dwolla supports, in its effort to create a more robust and efficient payment ecosystem tailored to the clients’ specific needs. By leveraging these integrations, companies can enhance their payment processes, improve security, and ultimately provide a better experience for their customers.

Who Should Use Dwolla

The versatile Dwolla e-wallet platform is suitable for a wide range of industries and cases. Here are just a few examples of how the platform can be employed to streamline payment processes and enhance overall experiences:

Online Retailers

: E-commerce businesses can integrate Dwolla payment solutions into their online stores, offering customers a secure and flawless way to make purchases.

Freelancers and Gig Economy Workers

: With quick and cost-effective money transfers, freelancers can receive payments from clients without the delays and fees associated with traditional banking methods.

Nonprofits and Charitable Organizations

: By leveraging Dwolla's customizable API, nonprofits can create tailored donation platforms that make it easy for supporters to contribute to their cause.

B2B Transactions

: Companies can utilize Dwolla's efficient and secure payment infrastructure to facilitate business-to-business transactions, simplifying their supply chain and reducing operational costs.

Subscription Services

: Dwolla's recurring payment feature makes it an ideal solution for subscription-based operations, allowing automated billing and ensuring consistent revenue streams.

Dwolla for Gamers and Online Casino Players

While Dwolla's primary focus is on providing a robust and secure payment platform for businesses and individuals, the platform also has potential applications in the gaming and online casino industries.

The e-wallet can be a valuable payment solution for online gamers and casino players due to its speed, security, and convenience. Here's a closer look at how Dwolla can benefit this specific user group:

Fast Transactions

When playing online games or engaging in online gambling, users often want their transactions to be processed more or less instant. Dwolla is designed to enable fast and efficient transactions, ensuring they can deposit and withdraw funds without unnecessary delays.

Security

Security is a crucial concern for online gamers and casino players, who want to ensure that their financial information and transactions are protected from potential fraud or cyberattacks. Dwolla features advanced security measures, including bank-level encryption and multi-factor authentication, to help safeguard sensitive information and keep funds secure.

Easy Integration with Gaming Platforms

Online gaming and casino platforms can easily integrate Dwolla e-wallet solution into their existing infrastructure, providing a user-friendly payment experience for their customers.

Regulatory Compliance

Dwolla is designed to comply with relevant financial regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements. This can be particularly important for online casino platforms, which must adhere to strict regulatory guidelines to maintain their operating licenses.

However, it's essential to note that the availability as a payment method for online casinos and gaming platforms may vary depending on the jurisdiction and specific platform policies. Always check the payment options available on your chosen gaming platform before proceeding.

Gig Economy

Dwolla e-wallet is a valuable tool for gig economy platforms, which often require a fast and efficient payment solution to manage transactions between service providers and customers. By integrating the wallet into their platforms, gig economy businesses can simplify the payment process, making it easier for service providers to receive payments and for customers to pay for services.

E-Commerce Payments

Dwolla is an ideal payment solution for e-commerce businesses looking to offer their customers a secure and user-friendly payment option. With easy integration into existing e-commerce platforms, the fintech solution enables round-the-clock and efficient payment processing.

Dwolla for Developers

Developers can visit the official page explaining the API integration process and all its components. Visit this official Dwolla Developers page here, for a more technical overview of the process.

Financial Services

Financial services companies can benefit from Dwolla’s secure and efficient payment processing capabilities. By integrating the digital wallet into their existing platforms, financial services can offer their clients a well-organized way to manage payments, transfers, and other financial transactions.

Marketplaces

Online marketplaces can leverage Dwolla to facilitate transactions between buyers and sellers. By providing a secure and efficient payment solution, marketplaces can improve the user experience for both buyers and sellers, ultimately driving more transactions.

U.S-Only Payment Networks

Currently, Dwolla services are only available within the United States. However, the platform can facilitate transactions for businesses operating outside the U.S., given they maintain a physical U.S. business location and intend to use its services for U.S.-based transactions.

To see which other digital wallets are popular in the U.S and Canada, check out our Top E-Wallets for North America post.

How to Get Started with Dwolla E-Wallet

Sign Up

To start using Dwolla, simply sign up for an account on their website. You'll need to provide some basic information about yourself or your business, including your name, email address, and password.

Choose a Pricing Plan

Dwolla offers various pricing plans to suit the needs of different businesses. Review the available plans and choose the one that best aligns with your requirements and budget.

Integrate Dwolla

If you're a developer or an entrepreneur looking to integrate Dwolla into your application or website, you can access the API documentation and other resources on the official website. These resources will guide you through the integration process, ensuring seamless implementation.

Start Using Dwolla

Once you've signed up and integrated Dwolla into your platform, you can start using the e-wallet to send, receive, and manage money. With its user-friendly interface and powerful features, Dwolla makes it easy for businesses and individuals to manage their financial transactions.

Dwolla Vs. Other Top Wallets for U.S.

Here are a few comparisons between other top e-wallets popular in the United States and Dwolla.

Dwolla vs. Venmo

While both Dwolla and Venmo allow for easy transfers of money, they serve different purposes. Venmo is primarily for personal use, enabling friends and family to quickly send and request money. The app is known for its social aspect where users can share their transaction details with their network. Dwolla, on the other hand, is more business-oriented, providing an API for companies to send, receive, and request payments within their software. Read our full Venmo Review to learn more.

Dwolla vs. PayPal

PayPal is a well-known payment system that caters to both personal and business transactions and is widely accepted by many online marketplaces and retailers. Dwolla, while less recognized by the general public, is known for providing a powerful platform for ACH transfers. Where PayPal has a broader focus, Dwolla’s strength lies in its specific purpose of enabling ACH payments.

Check out our full PayPal Review here.

Dwolla vs. Zelle

Zelle is a fast, safe, and easy way to send and receive money from friends, family, and others you trust. It's usually built directly into most bank's mobile app, making it convenient for users. Dwolla, on the other hand, provides an API for companies to build their own payment solutions. This makes Dwolla more versatile for business applications, while Zelle is more consumer focused. To learn more, check out our full Zelle Review.

Dwolla vs. Wise (formerly TransferWise)

Wise is primarily aimed at international money transfers, offering low-cost, transparent fees, and real exchange rates. It's used by both individuals and entrepreneurs to send money abroad affordably. Dwolla, however, doesn’t support international transfers directly but excels in facilitating domestic ACH transfers for businesses through its API. To learn more, dive into our full Wise Review.

Overall, the best wallet for you or your business depends on your specific needs, whether it's domestic ACH transfers, international transactions, personal payments, or social interactions.

Final Thoughts on Dwolla E-Wallet

Dwolla delivers a cutting-edge API, enabling companies to effortlessly link with the payment systems across the United States. Dwolla has established itself as a competitive player in the e-wallet space. The platform's extensive developer resources, white-label solutions, and dedicated customer support further enhance its appeal, making it an attractive choice for many different client bases.

As the digital payment landscape continues to evolve, Dwolla's commitment to innovation and adaptability ensures that it remains at the forefront of the U.S. e-wallet market, catering to the changing needs of its customers and consistently delivering a high-quality payment experience.

Check out our in-depth reviews for other top e-wallets:

Apple Pay

Google Pay

Samsung Pay

N26

Revolut