In 2018 the global fintech market was valued at $127.66 billion. And the annual growth rate until 2022 was predicted at 25% bringing it to a total value of $309.98 billion. While this is still

only a small percentage of the global financial services market, it is very impressive for a nascent industry.

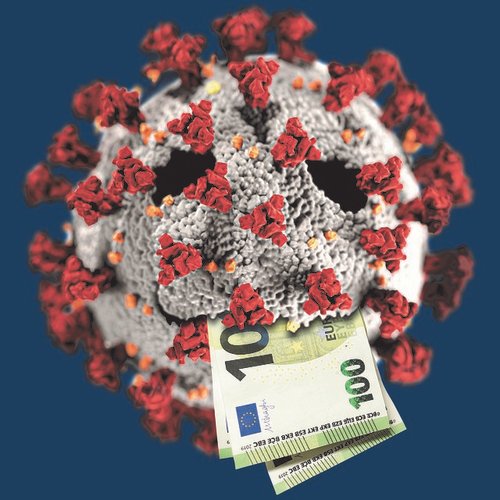

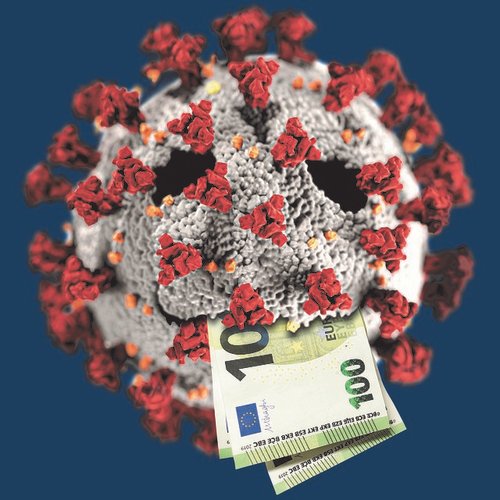

Of course, the COVID -19 pandemic has caused a significant amount of disruption in the global economy. As a result, many predictions and projections have had to be revised downwards across the board.

Fintech, along with virtually every other sector of the economy, has suffered in terms of investment. The second quarter of 2020 saw a 30% reduction in investment in fintech in the UK - $760m compared to over $1.2bn in the same period in 2019.

Source: www.raisin.co.uk

Resilience and Adaptability

Overall, however, most fintech companies have proved resilient and demonstrated an ability to adapt that gives them hope of weathering the storm intact. Their agile operations, suitability for and willingness to embrace remote working, and high levels of equity finance have allowed them to withstand the crisis.

Research has shown that merely 1% of FinTechs have been affected critically by COVID-19, with a further 2% severely affected. This is compared to the 17% of companies in other high-growth sectors that fall into these categories.

This is perhaps not surprising as the industry itself was born out of crisis. FinTech emerged as a result of the 2007/08 global financial crisis. Times of great uncertainty are also times of great innovation. In the aftermath of the chaos caused by the financial crisis, heavy investment in FinTech startups began to revolutionise the financial service industry.

Many FinTechs have experienced a significant increase in demand as the ongoing pandemic continues to change work practices and consumer banking habits.

New Technologies for New Needs

Prior to the pandemic, technology had already considerably changed the face of financial service provision. Fintech allowed for faster, more efficient and typically cheaper banking services. This left traditional financial services struggling to adapt. It was becoming increasingly clear that FinTechs would play a pivotal role in the future of financial services

This process has undoubtedly been accelerated by COVID-19. As companies around the world re-evaluate their business models, remote capabilities are becoming a corner stone of new strategies. And the demand for online financial services is increasing rapidly.

Traditional financial services have been forced to speed up their digitalisation plans considerably to meet this new demand. And FinTechs are there ready to offer innovative solutions and services.

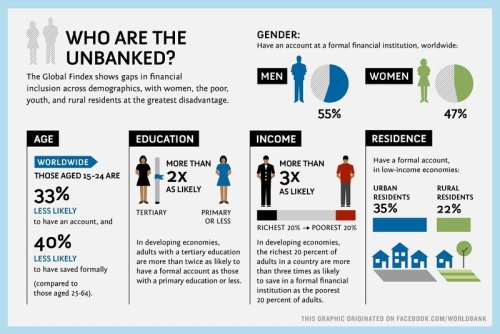

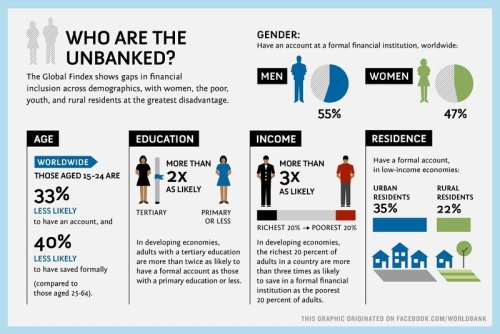

Source:www.worldbank.org/globalfindex

Financial Inclusion

As the global economy struggles to mitigate the effects of COVID-19, one particular area of concern is financial inclusion. The World Bank estimates that there are roughly 1.7 billion individuals without a bank account in the world today. FinTechs are key to providing these people with access to financial services.

In partnerships with financial institutions, retailers and government agencies, FinTechs can

provide basic financial services in a fair and transparent way to economically vulnerable populations. This will help to alleviate the negative social and economic consequences of the pandemic.

Safety First

Digital finance is also becoming more popular for other reasons. Physical cash payments

have fallen due to concerns that handling money will increase the spread of the virus. Digital payments and ewallet applications are fast becoming the norm in some societies.

The decline of cash was already predicted. In Sweden, for example, 80% of the population no

longer carry physical money, only cards. But the pandemic has pushed this process forward considerably. In a worldwide Mastercard survey on the implications of the pandemic, 82 percent of respondents regarded contactless payments as the cleanest option payment. And 74 percent indicated they would continue using contactless post-pandemic.

Source: Vanderpixa

Security Concerns

With the rise in demand for online financial services since the start of the pandemic came a rise in digital fraud and cyber-crime. To counter this there is an increasing need for improved “Know Your Customer” requirements. Strong cyber defences are becoming ever-more crucial as the global economy and financial systems moves more online. Security has always been an over-riding concern with FInTechs and they are designing products with precisely this need in mind.

The Way Forward

As we settle into a post-pandemic world of remote working, traditional financial institutions will have to make digital transformation a primary focus for the coming years. Many previous efforts to integrate technology have been limited to transferring certain teller services online. Thanks to the pandemic, these FIs are waking up to the fact that a much more comprehensive approach is needed to maintain an efficient and sustainable service.

This means utilizing and integrating fIntech solutions into their organisations. To date,

there have been three main models for doing so. These are;

Referral partnerships – in this model, the bank refers customers to its fintech partner and receives a commission. This is the preferred model for institutions who do not want to invest heavily in developing new services.

Assisted private-label partnerships – The most common form of partnership. Here, both

the institution and the FinTech partner control and are responsible for the customer experience. This allows the bank to gain all the benefits of financial technology solutions without the cost of developing and managing them.

Private-label partnerships – The model preferred by the larger banks and financial institutions. Here the fintech solution is purchased outright, customized, branded and sold to customers. This allows a seamless banking experience for clients, but involves more internal resources for sales, marketing and support.

There is also a fourth model, which has become increasingly common since the start of the

pandemic. And that is financial institutions purchasing or merging with FinTech startups. Goldman Sachs currently leads the field here with a strategy of acquiring startups that can add value to existing services and develop new ones. But others, such as France’s Société Générale, are following closely behind.

As we come to grips with our new, post-pandemic reality, one thing is sure. Fintech is here

to stay, and bricks-and-mortar bank branches, along with cash payments, will soon become the exception rather than the rule.