Covid 19 has accelerated the global move towards a cashless society. As online working becomes the norm, we will also conduct more and more of our financial transactions over the Internet. Fintech, once a niche market, is becoming mainstream. So what exactly is it, and how does it differ from traditional banking?

What is Fintech?

The term fintech is formed by combining the words Finance and Technology. It refers to both companies and services that utilize technology to deliver financial services to consumers and businesses.

It comprises different financial activities, including:

online money transfers,

depositing a check with a smartphone,

bypassing a bank branch to apply for credit,

raising money for a business startup, or

managing your investments, generally without the assistance of a person.

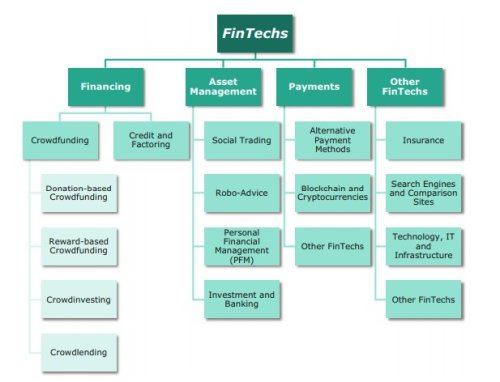

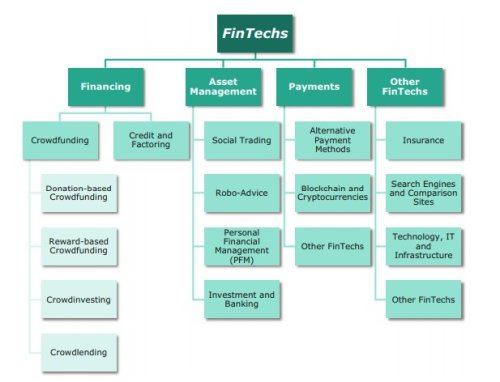

The chart below outlines the areas in which fintech operates;

One of the features of Fintechs is that they tend to focus on providing specialized services. They answer specific client needs, that is, a narrow aspect of their financial lives. This might be very appealing to customers wishing to handle particular financial undertakings.

But this narrow focus is also their biggest vulnerability. Clients that need financial handling of their whole businesses find this fragmentation frustrating. Studies have revealed that a significant percentage of consumers, even young ones, are not excited about using different providers to manage different financial needs. These include deposits, borrowing, investing, and retirement plans

Traditional Banks Overview

Traditional banks operate with an entirely different set of dynamics.

They are the first financial intermediaries that act as depository institutions, by maintaining deposits and offering loans. Aside from that, they directly control the portion of the checkable deposits of the economy's money supply.

Additionally, there are other types of banks, as a group commonly termed thrift institutions. They include credit unions, savings and loan associations, and mutual savings banks.

They all tend to base their business on and around very strong relationships with the clients. This, so to say, alliance, has been in place for years.

Traditional banks retain the advantage of recognizable brands and large customer bases. This particularly consists of older clients who have grown up doing business with human tellers in a ‘brick-and-mortar’ locations

Traditional banks can still leverage the convenience of in-person contacts, even after introducing their digital strategies and services. There is a logical correlation between the number of services an institution can offer to its consumer, and that consumer’s reticence to move their financial business elsewhere.

One of the major disadvantages when it comes to bank dealings is the costs of their services. Nothing is for free, and that is especially true when it comes to the banks. Having an account costs, getting a monthly report of transactions carried out might cost, and even using an ATM from a different bank may have an additional fee.

To make it worse, you even have to wait for the transactions to take place. Sure, maybe transferring funds from one account to another, in the same bank, might happen within minutes. But this is certainly not a case with other kinds of transfers.

Fintech vs Traditional Banks

When discussing differences between the two, the most significant one rests in their purpose. Fintech products are created to cover a perceived gap in the marketplace, whereas legacy institutions cater to a wider customer base. Banks mainly focus on the management of risk whereas Fintech firms focus on facilitation of the customers’ experience.

Traditionally, banks are known for their very resilient business model, which is based on trust and security, significant capitalisation and customer indifference. However, they are very process-oriented. This system and framework restrict their ability to keep up with new technologies. It also restricts their ability to create new products and services which can address the customer needs.

On the other hand, Fintech avails itself of mobile functionality, big data, accessibility, agility, cloud computing, contextuality to provide personalisation and convenience. They cater to and accelerate the changes in customer preferences and expectations driven by mobiles platforms, smartphones and social media.

In terms of improving user experience, banks are now experimenting with features Fintech companies are offering. These efforts are meeting with various degrees of success.

Some have failed miserably in their attempts to move into the digital age. For example, the Royal Bank of Scotland, RBS,

killed off their digital banking app, Bo, just 5 months after launching it.

Others, who have decided to partner with fintech companies, have had more success. Deutsche Bank recently announced a

partnership with Traxpay to integrate supply chain financing technologies and solutions within Deutsche Bank's own offering. As Daniel Schmand, global head of Trade Finance and Lending at Deutsche Bank, explained;

"With Traxpay we have an experienced partner with a good track record. We can work with them to offer our clients further solutions in this area. Our answer to the question 'FinTech or bank' is: 'FinTech AND bank.”

Final Word

Traditional Banks are more process-oriented. This system and framework provides security but restricts their ability to keep up with new technologies. It also restricts their ability to create new products and services which can address customer needs.

Fintech’s implementation of new-age data is more customer-oriented. This structure encourages not only innovation but the ability to tear down and rebuild its non-performing elements. But the narrow focus of most fintech companies limits their appeal to a wider client base.

However, these weaknesses on both sides can be addressed through collaboration between the two, not competition. And it seems the financial world is finally waking up to this fact. In the coming years, we will see an increasing

number of online financial services become available through such partnerships.